Businesses across Great Britain have been facing unprecedented challenges over the past few years.

COVID and Brexit were bad enough. Before the recovery could mature, the high energy prices inflated due to the ongoing Russia-Ukraine conflict have hit where it hurts most.

If something is not done about it right now, many businesses will not survive the winter.

While Ofgem has revised the energy-cost cap for households to £3,600 from October, there are no such protections for small and medium businesses.

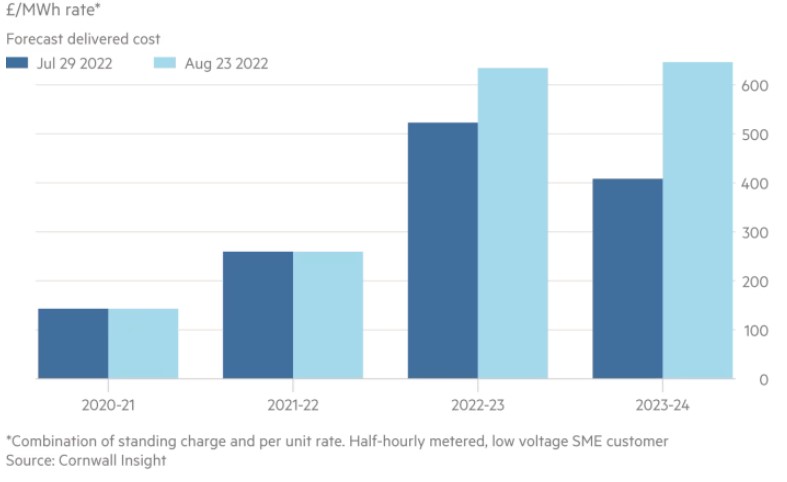

According to research firm Cornwall Insights, firms are likely to pay £634 per megawatt hour this autumn, which is double last year’s cost.

In June, Equals Money conducted a business sentiment survey among 1000 UK business executives and found that:

- 28% find the current scenario very challenging, and

- 20% worry that they might go out of business.

The top reasons:

- Rising energy costs

- Supply chain problems

- Delayed payments from debtors

- Lesser demand

- High-interest rates

Liz Truss, Britain’s new prime minister, is unlikely to have the budget to offer support for all the rising costs expected to hit UK businesses.

The rising cost of energy alone would inflate overheads by at least £20,000 annually for the smallest businesses.

The situation is worrying, but one must take adequate measures to combat the negative drivers to focus on the positives. And don’t worry, not all is lost.

How to tackle the crisis?

As a business owner, you have the below 3 options, if you’re on your own.

1. Invest the excess

If your business is sitting on some extra cash, why not make it work for you? Investing in the stock market or crypto could turn out to be a very profitable enterprise. If you are lucky, it could even pay for the entire excess outlay.

2. Reduce overheads

This is easier said than done. But trimming the flab ruthlessly can probably help your business stay afloat. Cut out the expenses with an eagle eye. But keep in mind that it should not be at the cost of reducing operational efficiency.

3. Look for alternatives

Look for more and better ways of doing business. Go online and list yourself on Google My Business. Change your logistics partner for someone who charges less. Look for cheaper alternatives where and when possible.

We’ve compiled this guide to help you invest your cash, and earn a decent ROI so that you can combat the cost and stress and maintain profitability.

How to invest to offset rising overhead costs?

Should a business invest money? That seems sort of counterintuitive for many small business owners.

Traditional wisdom always holds out sage advice, such as investing more in capital infrastructure or buying out a new business with excess cash.

While they cannot be faulted, a typical business owner in the UK might not at this moment want to redecorate their showroom or expand their IT infrastructure.

Investing money could help provide a small and steady income of about £6,000 every year. Not enough to solve the problem entirely, but a nice financial cushion to have.

We explore the most effective options that contribute, yet do not take up a lot of time to execute with a relatively medium risk factor.

Invest in stocks

Stocks or shares of a company are a good source of income. Profits from the sale of stock are subject to capital gains tax.

Stocks or shares of a company are a good source of income. Profits from the sale of stock are subject to capital gains tax.

They have some advantages:

- You can sell when the price rises or hold on to it.

- You enjoy a dividend as long as you hold.

- You can liquidate swiftly with one mouse click.

- You can invest any amount, at any time.

We recommend you invest in shares on FTSE or NASDAQ.

FTSE 100

The Financial Times Stock Exchange 100 index, or FTSE 100, is a group of top-performing stocks on the London Stock Exchange.

Launched in January 1984 with a base of 1,000, it is now at 7,300.

The companies making it up are diversified, ranging from Airtel Africa to BAE Systems and FMCG giant Unilever.

In the past decade, the average return from FTSE 100 has been 7.4%.

In 2021, the market gave a return of 14%.

An investment of £10,000 would have given returns of £1,140.

Of course, the performance of individual stocks was better.

At the time of writing, Shell PLC is trading at £2,319, a rise of 60% in the past 12 months.

If you had invested £5,000 in Shell PLC a year ago, it would be worth £8,000 now.

Airtel Africa has risen by 38% and BAE Systems by 39% in the same period.

NASDAQ 100

The full form of NASDAQ is the National Association of Securities Dealers Automated Quotations Stock Market.

It is the world’s second-largest stock exchange after NYSE.

NASDAQ is owned by Nasdaq Inc. and is entirely online.

Though it is a US-based entity, it does not mean you can’t invest there. All you must do is fill out a W-8BEN form online so that your income is not taxed in the USA.

All the major brokers in the UK also handle trading in NASDAQ through partnerships and tie-ups with US brokerages.

The annualized return from NASDAQ 100 in the past decade has been 21%.

Though 2022 has seen a sharp dip, the preceding year saw returns touch 26%.

An investment of £10,000 would have seen returns of £2,600.

An investment of £10,000 in Tesla in 2017 would have seen it grow to £100,000.

You need to employ a stockbroker.

You are not allowed to buy stocks without an intermediary known as a broker.

IG, Interactive Brokers, Fineco, Trading 212, Saxo Markets, and Free Trade are some of the most reputed and you can take trading courses to make better and less risky investments.

If you are looking for a low-cost trading platform that charges zero commission, then eToro is popular.

If you are looking for a trading house that offers fantastic research, then Hargreaves Lansdown, though expensive, is the best.

What must you look out for?

- Stocks go up but they also go down. Know your risk appetite and liquidate your holdings if it hits the lower marker (the stop loss target recommended by pundits and your broker).

- Do not act on wild tips. It is the easiest way to go bankrupt. Your neighbor’s cousin does not know which stocks would perform best in 2023.

- Study the fundamentals of the business carefully before investing. Profit and Loss Accounts and Balance Sheets of publicly traded companies are readily available online and with your broker. Make informed decisions.

- Invest for at least 6 months horizon. Weekly dips should not upset your broader timetable. Technical trading or momentum investing (also known as day trade) is wildly unpredictable and requires full-time attention. Day traders who are successful do that one thing alone. Emulating them without years of training is a surefire way to lose your corpus.

How much can you earn?

Assuming you choose a stock that rises 8% over the next year, to earn £6,000 you need to invest £75,000.

At 4% you need to invest £150,000.

At 15% you need to invest £40,000.

The safest bet is to consult a stockbroker and only invest the money you can also afford to make a loss with over time as stocks do not always go up.

Safe investing with an ISA

You might not like the risk that we associate with stocks. In that case, individual savings account also known as ISA is a safe choice and several investment banks offer these.

You might not like the risk that we associate with stocks. In that case, individual savings account also known as ISA is a safe choice and several investment banks offer these.

There is no difference in operation with a regular savings account, but an ISA is tax-free.

There is a limit to savings, however. At most, you can put away £20,000 annually.

A Cash ISA can offer you security because it can never go down.

But with that security come lower interest rates.

For Easy Access ISA plans, Paragon Bank is offering 1.55% and Skipton Building Society 1.6% and that appears to be the higher yield at this time.

In general, under the prevailing economic scenario, a one-year fixed rate ISA would bring 2.6% and a two-year deposit would fetch 3%.

An investment of £10,000 would have seen returns of £260 after a year and £600 after two years.

Please note: Interest rates fluctuate, so make sure you always check the current rates first.

What must you look out for?

- Know your tax liability beforehand. ISA is for the middle class.

- The business cannot invest in ISA. You must be the investor on behalf of the business.

- Comparison websites are a good starting point but to get the best deal, shop around on Main Street.

How much can you earn?

Assuming you choose an ISA plan that pays 1.6% over the next year, to earn £6,000 you need to invest £375,000.

At 3% you need to invest £200,000.

Tap into experts with funds

What if you want both safety and returns? What if someone with a lot of understanding picked stocks for you?

There is such an instrument and a quite well-known one too – mutual or investment funds.

Mutual funds handle money on behalf of clients.

The funds may trade in equity and stocks, government and corporate debt, and a mix of the two. The prospectus of the particular fund provides the details of what it will invest in and how.

Some funds focus on a sector such as Pharma, Tech, and Core (steel and cement).

There are hundreds of different mutual funds, with Franklin Templeton, Prudential, and Lloyds being the biggest names. Prudential alone offers 70 different funds.

Some funds are ETF or exchange-traded (making them easier to liquidate).

If one takes a medium-term view (2-5 years) mutual funds are considered safe as long as they are owned by reputed organizations.

Of course, safety comes at a cost and there is a cost of entry and exit (known as entry and exit load) and management fees.

But in return, it takes away the headache of administration.

What must you look out for?

- The institution must have a stellar reputation.

- Study returns of the past five years offered by different schemes before making a choice.

- Go over the prospectus and understand details of entry and exit load and capital gains tax. It makes no sense to earn 5% and pay 1.5% exit load and capital gains.

How much can you earn?

Assuming you choose a debt mutual fund that pays 3.5% over the next year, to earn £6,000 you need to invest £172,000.

If you invest in a pure equity mutual fund that pays 14% you need to invest £42,900.

Performance of mixed funds (debt and equity) varies between 5 and 10% and you would need £60,000 to £120,000.

(Maybe) Millions from crypto

Cryptocurrency such as Bitcoin has dominated any investment conversation for the better part of the last decade.

Cryptocurrency such as Bitcoin has dominated any investment conversation for the better part of the last decade.

It has gone from a curiosity to a gold rush to just another mainstream investment in this period.

To put it simply, cryptocurrencies are online, decentralized, digital currencies.

No government backs them. Their price depends on very different fundamentals and how and why crypto rises and falls in value is beyond the scope of this article.

Having said that, crypto has made many millionaires and billionaires. It has also made crypto billionaires into crypto millionaires.

£10,000 invested in crypto in 2017 would be worth £50,000 today. But at its height in 2021 October would have been worth £170,000.

Since cryptocurrencies are new and highly volatile, annualized rates have no meaning.

Since cryptocurrencies are new and highly volatile, annualized rates have no meaning.

What must you look out for?

- Extreme volatility and unpredictability. Do not invest in crypto unless you can afford to lose that sum.

- Invest with top-notch exchanges such as Coinbase and Binance. Otherwise, you might find it hard to liquidate your holdings.

- Do not seek tips from strangers on Reddit. Do not go on the DarkNet to look for advice from Estonian coin miners.

How much can you earn?

Assuming you invest in a bull market (when crypto is heading up) to earn £6,000 you need to invest £3,000. Conservative estimates put crypto returns at 100% annually when the market is rising. Caveats that apply: extreme volatility, lack of underlying economic fundamentals, and unknown factors.

Last thoughts

Tough times don’t last. Tough people do.

Surely you and your business would survive the turmoil. It is difficult, not impossible. So, keep calm and hang on and make prudent, information-driven investments. In a year, things would look brighter. Make smart decisions for your business budget when costs rise. You can also consult a top London accounting firm for help with business financing.

Author Profile

- CEO - ClickDo™ & SeekaHost™ | Started as an SEO Consultant and helped over 400 UK business owners grow their business with online marketing and Google advertising. More details about Fernando Raymond are available at www.fernandoraymond.com.

Latest entries

BusinessFebruary 24, 2025The Cost of Owning a Business in London

BusinessFebruary 24, 2025The Cost of Owning a Business in London Business AdviceDecember 26, 2024Hybrid Cloud Infrastructure – 5 Pros and Cons of a mixed Computing Environment

Business AdviceDecember 26, 2024Hybrid Cloud Infrastructure – 5 Pros and Cons of a mixed Computing Environment Business AdviceAugust 7, 2024What is SEO & Link Building & Why Should Business Owners Care

Business AdviceAugust 7, 2024What is SEO & Link Building & Why Should Business Owners Care Business AdviceMarch 28, 2024Streamlining Operations – Innovative Solutions for Modern London Businesses

Business AdviceMarch 28, 2024Streamlining Operations – Innovative Solutions for Modern London Businesses